AT THE NEXUS OF SOLUTIONS, IMPACT, AND INNOVATION.

We invest in innovative balance sheet solutions at scale, taking exposure to specialized loan portfolios through custom risk-transfer structures alongside the world’s largest financial institutions. With expertise across a range of corporate, project finance, object finance, asset-backed, and esoteric loan portfolios, our investments include renewable energy, affordable housing, power, real estate, transportation, and social infrastructure assets.

We aim to establish new markets and apply our skills to new areas of investment opportunity. Our creative professionals have completed several first-of-their-kind transactions, applying securitization techniques to new asset classes and new geographies as we seek to originate compelling value-added investment opportunities on behalf of our partners.

Impact is at the top of our agenda. We employ structured finance to improve environmental and societal outcomes. We have built portfolios with green and pro-social assets while our investments have also catalyzed billions of dollars of fresh lending to urgently needed climate resiliency, affordable housing, and development finance projects.

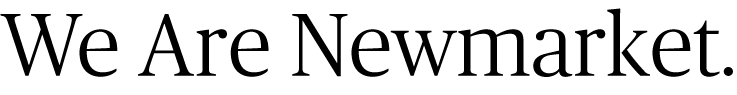

OUR INVESTMENT STRATEGY

![]()

Newmarket is an active participant in the structured finance and risk transfer markets, seeking to generate favorable risk-adjusted returns for our limited partners.

We deliver dependable and efficient execution for our global network of financial institutions, as they seek to navigate an increasingly demanding capital environment.

We are proud to have partnered with multiple leading public and private financial institutions to invest in structures that advance broader objectives for social and environmental impact.

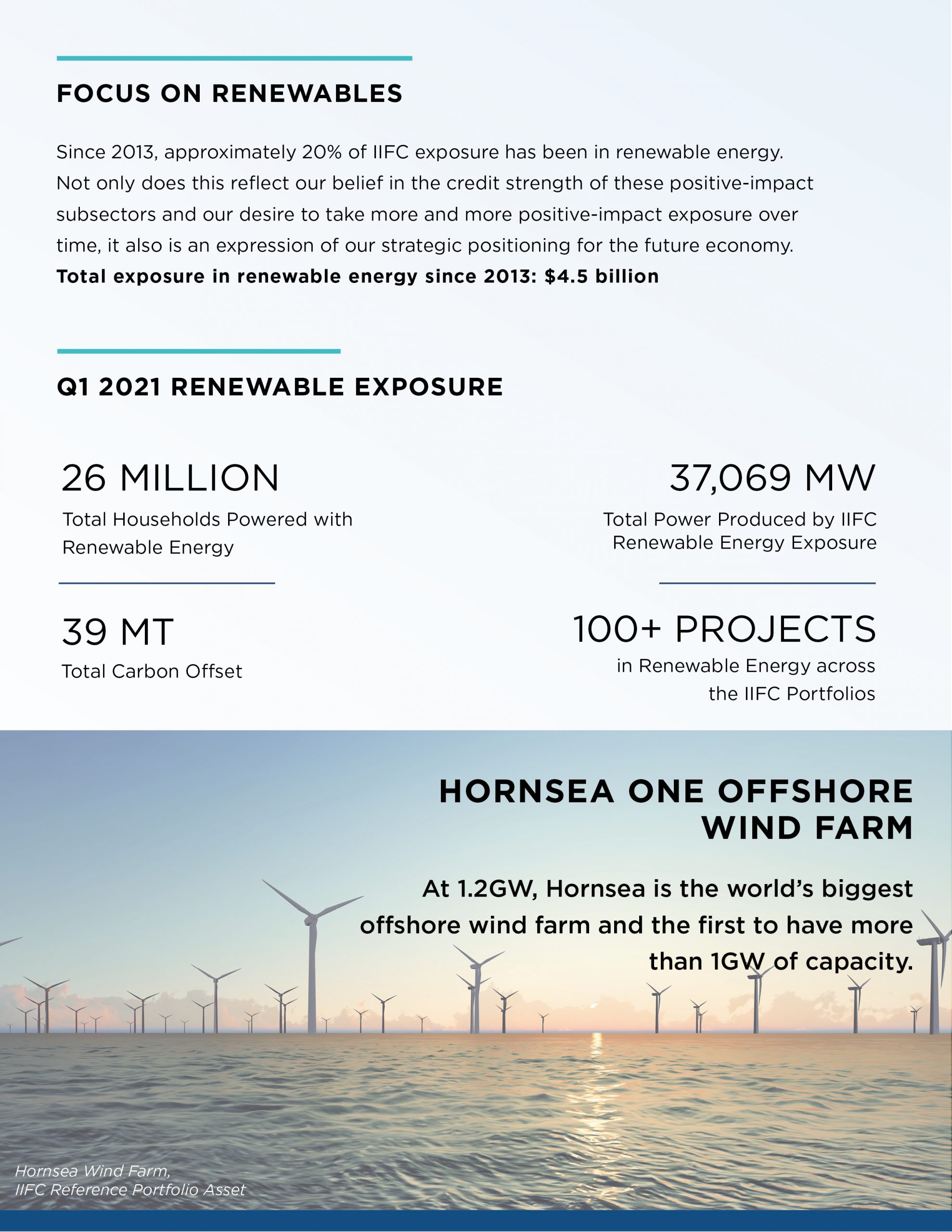

IMPACT

![]()

Newmarket is committed to promoting positive social and environmental change through our investments. We take pride in our award-winning partnerships in impact and continue to demonstrate leadership in scaling institutional-quality structures into the impact investment market.

Over $5 billion of our historical exposure is in positive impact sectors, including renewable energy, affordable housing, and social infrastructure.

In addition, the redeployment commitments embedded in our impact investments have directly catalyzed more than $3 billion in new bank lending to climate resiliency, renewable energy, social infrastructure, and development finance projects worldwide.

PRESS HIGHLIGHTS